How to use rsi to buy stocks

Welles Wilder, the Relative Strength Index RSI is a momentum oscillator that measures the speed and change of price movements. RSI oscillates between zero and Traditionally, and according to Wilder, RSI is considered overbought when above 70 and oversold when below Signals can also be generated by looking for divergences, failure swings and centerline crossovers. RSI can also be used to identify the general trend. RSI is an extremely popular momentum indicator that has been featured in a number of articles, interviews and books over the years.

In particular, Constance Brown's book, Technical Analysis for the Trading Professional, features the concept of bull market and bear market ranges for RSI.

Technical Analysis in Excel - MACD and RSI indicators

Andrew Cardwell, Brown's RSI mentor, introduced positive and negative reversals for RSI. In addition, Cardwell turned the notion of divergence, literally and figuratively, on its head. Wilder features RSI in his book, New Concepts in Technical Trading Systems.

This book also includes the Parabolic SAR, Average True Range and the Directional Movement Concept ADX. Despite being developed before the computer age, Wilder's indicators have stood the test of time and remain extremely popular. To simplify the calculation explanation, RSI has been broken down into its basic components: RS , Average Gain and Average Loss. This RSI calculation is based on 14 periods, which is the default suggested by Wilder in his book.

Losses are expressed as positive values, not negative values. The second, and subsequent, calculations are based on the prior averages and the current gain loss:.

Taking the prior value plus the current value is a smoothing technique similar to that used in exponential moving average calculation. This also means that RSI values become more accurate as the calculation period extends.

SharpCharts uses at least data points prior to the starting date of any chart assuming that much data exists when calculating its RSI values. To exactly replicate our RSI numbers, a formula will need at least data points. Wilder's formula normalizes RS and turns it into an oscillator that fluctuates between zero and In fact, a plot of RS looks exactly the same as a plot of RSI.

The normalization step makes it easier to identify extremes because RSI is range bound. RSI is 0 when the Average Gain equals zero. Assuming a period RSI, a zero RSI value means prices moved lower all 14 periods. There were no gains to measure. RSI is when the Average Loss equals zero. This means prices moved higher all 14 periods.

How to Day Trade with the RSI - Tradingsim

There were no losses to measure. Here's an Excel Spreadsheet that shows the start of an RSI calculation in action. The smoothing process affects RSI values. RS values are smoothed after the first calculation. Average Loss equals the sum of the losses divided by 14 for the first calculation. Subsequent calculations multiply the prior value by 13, add the most recent value and then divide the total by This creates a smoothing affect.

The same applies to Average Gain. Because of this smoothing, RSI values may differ based on the total calculation period. Similarly, RSI equals 0 when Average Gain equals zero.

The default look-back period for RSI is 14, but this can be lowered to increase sensitivity or raised to decrease sensitivity. The look-back parameters also depend on a security's volatility. RSI is considered overbought when above 70 and oversold when below These traditional levels can also be adjusted to better fit the security or analytical requirements. Short-term traders sometimes use 2-period RSI to look for overbought readings above 80 and oversold readings below Wilder considered RSI overbought above 70 and oversold below Chart 3 shows McDonalds with day RSI.

This chart features daily bars in gray with a 1-day SMA in pink to highlight closing prices because RSI is based on closing prices. Working from left to right, the stock became oversold in late July and found support around 44 1.

Investopedia - Sharper Insight. Smarter Investing.

Notice that the bottom evolved after the oversold reading. The stock did not bottom as soon as the oversold reading appeared.

Bottoming can be a process. From oversold levels, RSI moved above 70 in mid September to become overbought. Despite this overbought reading, the stock did not decline.

Instead, the stock stalled for a couple weeks and then continued higher. Three more overbought readings occurred before the stock finally peaked in December 2. Momentum oscillators can become overbought oversold and remain so in a strong up down trend. The first three overbought readings foreshadowed consolidations. The fourth coincided with a significant peak.

RSI then moved from overbought to oversold in January. The final bottom did not coincide with the initial oversold reading as the stock ultimately bottomed a few weeks later around 46 3.

Like many momentum oscillators, overbought and oversold readings for RSI work best when prices move sideways within a range.

Chart 4 shows MEMC Electronics WFR trading between The stock peaked soon after RSI reached 70 and bottomed soon after the stock reached According to Wilder, divergences signal a potential reversal point because directional momentum does not confirm price. A bullish divergence occurs when the underlying security makes a lower low and RSI forms a higher low. RSI does not confirm the lower low and this shows strengthening momentum.

A bearish divergence forms when the security records a higher high and RSI forms a lower high. RSI does not confirm the new high and this shows weakening momentum. Chart 5 shows Ebay EBAY with a bearish divergence in August-October. The stock moved to new highs in September-October, but RSI formed lower highs for the bearish divergence. The subsequent breakdown in mid October confirmed weakening momentum. A bullish divergence formed in January-March. The bullish divergence formed with Ebay moving to new lows in March and RSI holding above its prior low.

RSI reflected less downside momentum during the February-March decline. The mid March breakout confirmed improving momentum. Divergences tend to be more robust when they form after an overbought or oversold reading.

Before getting too excited about divergences as great trading signals, it must be noted that divergences are misleading in a strong trend. A strong uptrend can show numerous bearish divergences before a top actually materializes. Conversely, bullish divergences can appear in a strong downtrend - and yet the downtrend continues.

These bearish divergences may have warned of a short-term pullback, but there was clearly no major trend reversal. Wilder also considered failure swings as strong indications of an impending reversal. Failure swings are independent of price action. In other words, failure swings focus solely on RSI for signals and ignore the concept of divergences. A bullish failure swing forms when RSI moves below 30 oversold , bounces above 30, pulls back, holds above 30 and then breaks its prior high.

It is basically a move to oversold levels and then a higher low above oversold levels. Chart 7 shows Research in Motion RIMM with day RSI forming a bullish failure swing. A bearish failure swing forms when RSI moves above 70, pulls back, bounces, fails to exceed 70 and then breaks its prior low.

It is basically a move to overbought levels and then a lower high below overbought levels. Chart 8 shows Texas Instruments TXN with a bearish failure swing in May-June In Technical Analysis for the Trading Professional, Constance Brown suggests that oscillators do not travel between 0 and This also happens to be the name of the first chapter. Brown identifies a bull market range and a bear market for RSI.

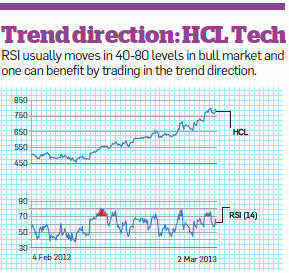

RSI tends to fluctuate between 40 and 90 in a bull market uptrend with the zones acting as support. These ranges may vary depending on RSI parameters, strength of trend and volatility of the underlying security.

Chart 9 shows week RSI for SPY during the bull market from until RSI surged above 70 in late and then moved into its bull market range There was one overshoot below 40 in July , but RSI held the zone at least five times from January until October green arrows.

In fact, notice that pullbacks to this zone provided low risk entry points to participate in the uptrend. On the flip side, RSI tends to fluctuate between 10 and 60 in a bear market downtrend with the zone acting as resistance.

RSI moved to 30 in March to signal the start of a bear range. The zone subsequently marked resistance until a breakout in December. Andrew Cardwell developed positive and negative reversals for RSI, which are the opposite of bearish and bullish divergences.

Cardwell's books are out of print, but he does offer seminars detailing these methods. Constance Brown credits Andrew Cardwell for her RSI enlightenment. Before discussing the reversal technique, it should be noted that Cardwell's interpretation of divergences differs from Wilder. Cardwell considered bearish divergences as bull market phenomenon.

In other words, bearish divergences are more likely to form in uptrends. Similarly, bullish divergences are considered bear market phenomenon indicative of a downtrend. A positive reversal forms when RSI forges a lower low and the security forms a higher low. This lower low is not at oversold levels, but usually somewhere between 30 and Chart 11 shows MMM with a positive reversal forming in June MMM broke resistance a few weeks later and RSI moved above Despite weaker momentum with a lower low in RSI, MMM held above its prior low and showed underlying strength.

In essence, price action overruled momentum. A negative reversal is the opposite of a positive reversal. RSI forms a higher high, but the security forms a lower high.

Again, the higher high is usually just below overbought levels in the area. Chart 12 shows Starbucks SBUX forming a lower high as RSI forms a higher high. Even though RSI forged a new high and momentum was strong, the price action failed to confirm as lower high formed.

This negative reversal foreshadowed the big support break in late June and sharp decline. RSI is a versatile momentum oscillator that has stood the test of time. Despite changes in volatility and the markets over the years, RSI remains as relevant now as it was in Wilder's days.

While Wilder's original interpretations are useful to understanding the indicator, the work of Brown and Cardwell takes RSI interpretation to a new level.

Adjusting to this level takes some rethinking on the part of the traditionally schooled chartists. Wilder considers overbought conditions ripe for a reversal, but overbought can also be a sign of strength. Bearish divergences still produce some good sell signals, but chartists must be careful in strong trends when bearish divergences are actually normal. Even though the concept of positive and negative reversals may seem to undermine Wilder's interpretation, the logic makes sense and Wilder would hardly dismiss the value of putting more emphasis on price action.

Positive and negative reversals put price action of the underlying security first and the indicator second, which is the way it should be. Bearish and bullish divergences place the indicator first and price action second. By putting more emphasis on price action, the concept of positive and negative reversals challenges our thinking towards momentum oscillators.

RSI is available as an indicator for SharpCharts. Once selected, users can place the indicator above, below or behind the underlying price plot. Placing RSI directly on top of the price plot accentuates the movements relative to price action of the underlying security. This scan reveals stocks that are in an uptrend with oversold RSI.

First, stocks must be above their day moving average to be in an overall uptrend. Second, RSI must cross below 30 to become oversold. This scan reveals stocks that are in a downtrend with overbought RSI turning down. First, stocks must be below their day moving average to be in an overall downtrend. Second, RSI must cross above 70 to become overbought. For more details on the syntax to use for RSI scans, please see our Scanning Indicator Reference in the Support Center.

Constance Brown's book takes RSI to a new level with bull market and bear market ranges, positive and negative reversals, and projections based on RSI. Some methods of Andrew Cardwell, her RSI mentor, are also explained and refined in the book.

Market data provided by: Commodity and historical index data provided by: Unless otherwise indicated, all data is delayed by 20 minutes. The information provided by StockCharts. Trading and investing in financial markets involves risk. You are responsible for your own investment decisions.

Log In Sign Up Help. Free Charts ChartSchool Blogs Webinars Members. Relative Strength Index RSI. Table of Contents Relative Strength Index RSI. Technical Analysis for the Trading Professional Constance Brown. Sign up for our FREE twice-monthly ChartWatchers Newsletter! Blogs Art's Charts ChartWatchers DecisionPoint Don't Ignore This Chart The Canadian Technician The Traders Journal Trading Places. More Resources FAQ Support Center Webinars The StockCharts Store Members Site Map. Terms of Service Privacy Statement.