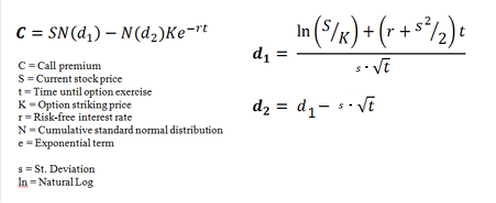

Stock options black-scholes calculator

While the Shareworks private market solution greatly simplifies the option valuation process we provide this Black-Scholes calculator to demonstrate a method that non-public companies find useful if their plan administration needs are minimal.

The Black-Scholes calculator is found below. Enter the values in the cells according to the instructions below.

isycihe.web.fc2.com Black-Scholes Calculator

Is your company ready to move beyond spreadsheets? Take a look at how easy it is to value your options using our platform.

This is only one example of a calculation that may be done in many different ways. It is being provided for informational or educational purposes only.

This file may not be shared with any third party and may only be used by the person who received it from Solium Capital Inc. In no event shall Solium Capital Inc.

By using this spreadsheet, you are agreeing to be bound by the legal limitations set forth above. If you do not agree, stop using this spreadsheet and delete it from your system.

Black-Scholes Calculator Online | FinTools

Knowledge Center Shareworks For Private For Public For Global Forms Filing Cap Table Global Compliance Synergy Remarkable Service Amazing Company Support Contact Us Open New Account Login. Back to main library Like our library?

Check out our newsletter for hand-picked articles from across the web. Instructions for Using the Black-Scholes Calculator The Black-Scholes calculator is found below.

Enter the fair market value of the option on the date of grant. Enter the exercise price of the option.

Free Black-Scholes Calculator for the Value of a Call Option

Enter the expected term of the option grant as calculated by SAB Enter the interest rate. Assuming the company does not have any dividends, leave this cell at 0.

Enter the volatility based on an appropriate number of public peer companies.

The values in the next two cells are part of the calculation, so do not change these values. After inputting the values you entered into the above cells, the fair value per share of the option displays.

Related content IPO and Stock Compensation: Request a Demo Input your own assumptions. Or let Shareworks calculate them using your plan data. You can even calculate peer volatility right in the platform.

Related solutions Shareworks Expense Accounting Shareworks Cap Table.