Where do i find volatility for a stock option

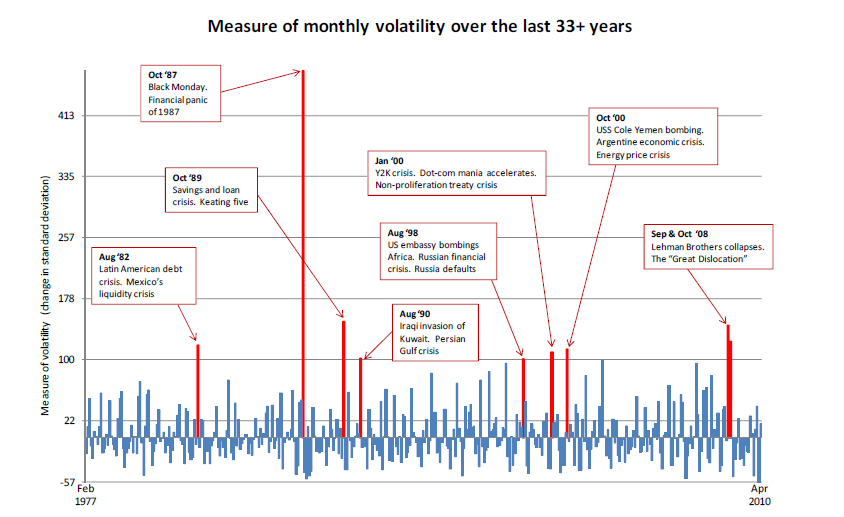

By John Summa , CTA, PhD, Founder of OptionsNerd. Just why this is so will become clearer once the difference between both volatility types is understood. This tutorial segment will focus on historical volatility , which is also known as statistical volatility SV.

Stock Options Analysis and Trading Tools on I isycihe.web.fc2.com

Historical volatility is a measure of the volatility of the underlying stock or futures contract. It is known volatility, because it is based on actual, recent price changes of the underlying. Historical volatility can be thought of as the speed rate of change of the underlying stock price.

Like a car speeding along at 75 mph rate of change per hour , a stock or futures contract moves at a speed that is measured as a rate too, but a rate of change per year. The higher the historical volatility, the more movement the stock has experienced and, therefore, theoretically, the more it can move in the future, although this does not provide insight into either direction or trend.

While there are different ways to calculate historical volatility different parameter settings just like with any technical indicator the basic idea underlying different calculations is fundamentally the same. Historical volatility essentially is a way to tell how far the stock or future might move in the future based on how fast it has been moving in the recent past.

But the catch here is that the rate of change of 75 mph may not stay the same, and it doesn't tell us much about the direction of car it could be going back and forth, not just in one direction, meaning it could end up where it began. This is true for stocks or futures as well.

Option Volatility: Historical Volatility

But the calculation clearly depends on recent speeds, which means percentage price changes on a daily basis. If these speeds are increasing, historical volatility will generally be greater. Calculating Historical Volatility By walking through a calculation of historical volatility, the above description should become more tangible. Historical volatility is a quantifiable number based on past changes in the price of the stock or futures contract.

It can be calculated simply by taking the past prices, in this example 10 days are used, and price changes from close to close , and then taking an average of those price changes in percentage terms. Once we have an average percentage price change over 10 days, we can subtract the daily percentage price changes from this average change to derive deviations from the daily average change for the day period.

Figure 1 contains an example using this method. The calculation involves use of a few concepts you might have encountered in a Statistics , such as mean , standard deviation and even square roots. The historical volatility calculation here uses the past 10 days of price changes. Typically a , or day period of past price changes is analyzed. As you can see in Figure 1, the middle column contains daily closing prices for IBM between July 3 and July 18, The right-hand column contains the daily price changes calculated by subtracting yesterday's price from today's closing price and dividing by yesterday's closing price.

This is the raw material for computing historical volatility. The data from Figure 1 is then used to compute the standard deviation of daily price changes, which can be done easily in an Excel spreadsheet using the STDEV function.

Historical vs. Implied Options VolatilityUsing the IBM price data for the calculation, Figure 2 presents current day historical volatility for IBM - let's suppose it's The number is an annualized figure that is derived by multiplying the standard deviation calculation of.

The standard convention is to annualize historical volatility and implied volatility ; it's an easy task using the square root function in an Excel spreadsheet.

To learn more, read Microsoft Excel Features For The Financially Literate. One additional thing to keep in mind is that while we are talking about the speed of the underlying, it is interpreted as an expected Let's now cook up some numbers to see how it changes historical volatility, which should facilitate a better feel for volatility.

Figure 3 shows new hypothetical closing prices for IBM, with the resulting new standard deviation and historical volatility results in Figure 4. Figure 3 presents IBM prices that have larger percentage price changes most of the entire period up and down.

When you compute standard deviation based on the new daily price changes seen in Table 3 in the right-hand column, you get 1. This simply reflects greater dispersion around the average price change not shown here , which will therefore lead when multiplied by IBM moved from The size of daily price changes was altered to illustrate how that will impact historical volatility.

When a big cap stock is having a bearish cycle, the daily price swings typically will expand, generating higher historical volatility. This hypothetical case attempts to capture that phenomenon. We'll go back to this point toward the end of this tutorial on using volatility to predict market direction.

There are a few issues worth mentioning here that go beyond the scope of this tutorial. A number of different methods are used to calculate historical volatility. Here close-to-close percentage changes in daily prices were used, but some have used high-minus-low prices, and even an average of high, low and close prices, in an attempt to capture some intraday information that is missing when close prices are used.

Another issue regards the calculation of historical volatility and trending versus trading range markets. It is possible for a strong trend to develop up or down without any change in the size of daily percentage price changes let's say the magnitudes remain the same but more positive days develop.

The average of daily price changes can become larger while historical volatility calculated using the popular method outlined becomes smaller. Likewise, it could be shown here, too, that if average daily price change declines in size, historical volatility can rise even when the market is trending stronger. Conclusion Now you've learned how to calculate statistical volatility historical volatility using a popular method. Ten days of daily percentage price changes were computed using closing prices from IBM, from which a standard deviation was calculated.

The standard deviation was then used to derive historical volatility, which is nothing more than annualized standard deviation of daily percentage price changes. While 10 days was used in the example here, 20 and 30 days are also common time frames used to calculate historical volatility.

We can now move on to discuss historical volatility's cousin, implied volatility, which is covered in the next section. To learn more, read Using Historical Volatility To Gauge Future Risk.

Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Historical Volatility By John Summa Share. Why Is It Important? Historical Volatility Options Volatility: Projected or Implied Volatility Options Volatility: Strategies and Volatility Option Volatility: Vertical Skews and Horizontal Skews Option Volatility: Predicting Big Price Moves Option Volatility: Contrarian Indicator Options Volatility: IBM closing prices and daily percent price changes. Standard Deviation Statistical Volatility 0. IBM statistical volatility using prices presented in Figure 1 One additional thing to keep in mind is that while we are talking about the speed of the underlying, it is interpreted as an expected Standard Deviation Statistical Volatility 1.

How to Calculate Historical Stock Volatility: 12 Steps

IBM statistical volatility using prices presented in Figure 3. Discover the differences between historical and implied volatility, and how the two metrics can determine whether options sellers or buyers have the advantage. Find out how to adjust your portfolio when the market fluctuates to increase your potential return.

Find out how much volatility global equity investors are in for during by seeing how much they've experienced over the past five years. If you can keep your head while those about you are losing theirs, you can make a nice return in roiling markets. Use these calculations to uncover the risk involved in your investments. Volatile stocks can be a lucrative opportunity for short-term traders. For buy-and-hold investors, it's a much different story. Check out how the assumptions of theoretical risk models compare to actual market performance.

You may participate in both a b and a k plan.

Option Volatility

However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Purchase life insurance in your qualified retirement plan using pre-tax dollars.

Be aware of other ways that life insurance Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.