Fx options payoff diagrams

Call Option Exercise Price: So, with a long call we have limited risk the Option Premium while at the same time having unlimited profit potential. Let's look at a graph of this concept;. The horizontal line across the bottom the x-axis represents the underlying instrument - in this example, the share price of Microsoft. You can see that the vertical distance between the 0 profit line and the blue line is our maximum loss, i.

If the market crashes and the stock goes bankrupt, our maximum loss will still only be the premium we paid.

For more option payoff charts, be sure to check out the option strategies link. Or, to see option strategies in action, take a look at the option tutorials section. Hi Ali, Yes, fair point there. Dear author, I am sorry, But the "blue line" you talked about is the "Profit". Its not the payoff. Payoff is the line which doesn't represent the impact of the Future values of costs and Premiums paid or received.

Hi Mahesh, The option will be worth at least its' intrinsic value - for a call option it will be the stock pice minus the strike price. So, there will always be a buyer at this price - typically a market maker who will offset it against the stock or another option.

You could also exercise the option if a call and take delivery of the stock and then sell it immediately in the open stock market to realise the gains. I'd say the best way to trade is to paper trade your ideas.

If you don't want to wait until opening a brokerage account before testing then you can use an application like Visual Options Analyzer [link removed as the product no longer exists] where you can enter trades and manage them against downloaded option prices.

Currency Options Trading - Payoff Diagrams Explained | hubpages

So what would be the best way to just 'test the waters' without extreme risk of loosing a lot of money? The least risky version of options trading?

Options Hazards That Can Bruise Your Portfolio

Within the last 30 days to expiration, even in the money options can take a beating. So, what is the best strategy? Hi Steve, if the bond doesn't convert to anything i. Unless I have misunderstood?

Will someone please offer some help? Hi Nancy, It really depends on your view of the underlying stock.

You can buy deep ITM money options as an alternative to buying the shares outright. Doing this means you can have a large exposure to the stocks' movements without spending as much to buy the shares. I'm struggling with how to arrive at a good strike price for a call. Does one ever choose, for instance, a strike price which is below the current stock price? As the price, goes up, I would still be profitable regardless of the strike price, right? Specifically, I'm looking at AMZN April call.

It is currently floating around that number now.

Could you make that clear to me? What figures do you mean They are not currency specific Hi, I was just wondering how recent these figures are?

It depends on your broker. Short positions require a margin, rather than just paying out the premium if you were to buy the option.

Foreign Exchange Option. Money Management | isycihe.web.fc2.com

A good guide, however, is to multiply the volume of contracts by the strike price and then multiplied by the contract size, which for US options is Hi Dolf, the question Carter asks is in relation to a naked call, not a covered call - they have different payoff profiles.

Sure, a covered call's losses is technically limited to the stock price going to zero. Not unlimited - but a lot. With a covered call, you're short a call option. Once the stock trades below the strike the holder of the option won't exercise, so you just lose the premium and the option value goes to zero.

Official Publications: Research Expertise and Publications - Research Publications

However, you are still long stock, which will lose value as the price drops - not unlimited, sure, but all the way to zero. As the stock rallies past the strike, yes, you would be called out and have to sell the stock at the strike price offsetting the long position already held in the stock making the profit realized the premium already received for selling it.

This is why a coverved call is a bullish strategy as you want the market to rally so you are called away and give up the stock. Peter, As Carter mentione two years ago: Yes if this is a naked call. I have been studying covered calls in my trek to learn options trading and if it were a covered call I personally don't view it as an unlimited loss.

I don't think this is a bad deal nor would I really cry about it if I got called out in this situation. I wouldn't necessarily buy back the same security if I got called out.

If the option is very close to expiration and a company is bidding up the options above their intrinsic value, market makers would arb them out by selling the options and hedging with the stock. Hi, silly question im sure Im guessing people get it wrong more than right and therefore it is extremely common to not exercise the trade.

I hope that makes sense. Hi Rajeev, Your clearer decides who the counterparty is if you decide exercise your option. The person on the other side will be a holder of a short call option. About your second question You would only be obliged to sell shares if you were short the call option and the buyer exercised the option. This is very useful After going through the whole thing, I have a question. If I decide to exercise the call option, who is the other side, who is going to sell the stock.

On the same thought, if I bought the call option for 1. Hi Tom, It depends on the specifications of the options, but generally, yes. In the US exchange traded options have a "multiplier" or "contract size" of , so the price is multiplied by However, in Australia the multiplier is 1, So it depends on the exchange where the options are traded.

Hi Chuck, It depends on the exchange. For example, in the US there is no charge for exercise and assignment for US stock options, however, in Australia and Europe you will be charged commissions.

This was taken from the Interactive Brokers website under Fees and Commissions: If you intend to exercise your in the money call option and sell the stock immediately to realize your profit, would you also incur two stock trade fees as well as the original option purchase fee? Are option trading fees similar to stock trading fees? The last trading day for April 09 options in the US is Friday the 17th.

CBOE shows the 18th Saturday as the expiration date but Yahoo! I couldn't see the 11th mentioned. I would say that's what it comes down to But really Friday is the last trading day Once the stock trades upwards past the strike price the buyer will certainly exercise the option as it is now?

Your losses have no limit and will continue to increase as the stock rallies. Why would our options be unlimited if the market rallies in the last example?

Payoff Diagrams The best way to understand option strategies is to look at a diagram of how they behave. Let's look again at the basics of a Call Option.

Here is an example; Underlying: The blue line is our payoff. What about if we sell a call option? However, if the market rallies then our losses become unlimited. Options What are Options?

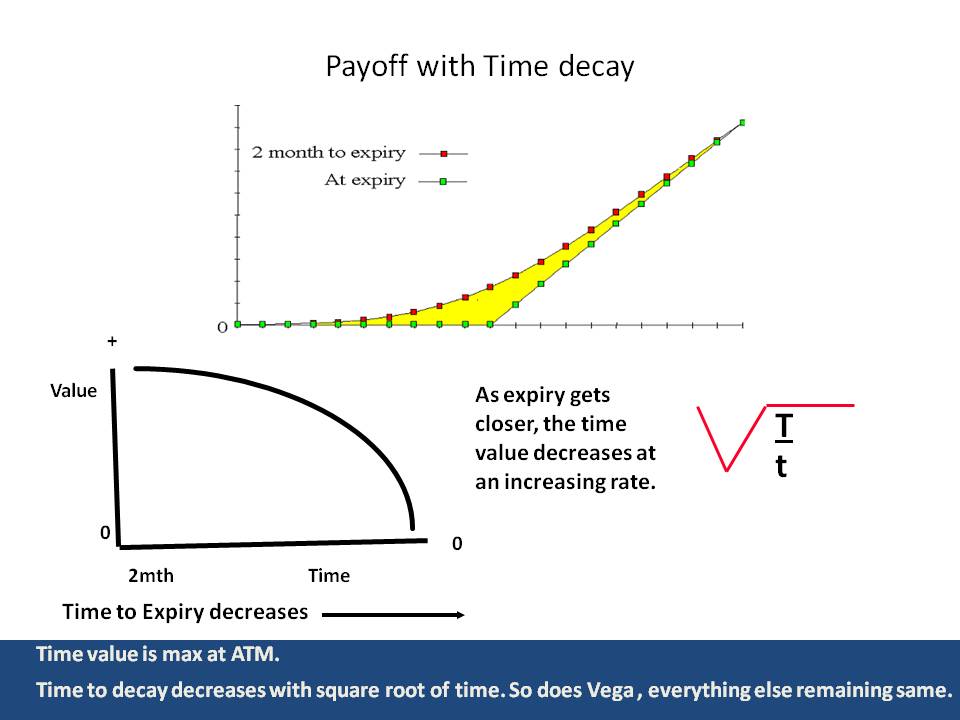

Where are Options Traded? Option Types Option Style Option Value Volatility Time Decay In-The-Money? Payoff Diagrams Put Call Parity Weekly Options Delta Hedging Options Asset Types Index Option Volatility Option Currency Options Stock Options. Comments 38 Peter February 6th, at 4: Ali February 5th, at 4: Actuarial Student mahesh February 26th, at 5: Jon February 15th, at 4: Peter February 6th, at 8: Jason February 6th, at 7: Peter October 30th, at 6: Steve October 28th, at 9: Nancy October 12th, at 9: Peter September 5th, at 5: Gurko September 5th, at 6: Peter December 7th, at 9: Peter October 9th, at 6: Peter June 9th, at Dolfandave June 8th, at 1: Thanks Peter May 21st, at 6: Rajeev May 20th, at 9: Peter May 5th, at 7: Tom May 5th, at Peter April 13th, at 7: Peter April 9th, at 7: Jack April 8th, at 1: Admin October 9th, at 4: Queenie October 6th, at 7: Admin October 3rd, at 8: Add a Comment Name.