Average yearly stock market returns

When you say "the yearly return from to " do you mean Jan 1,through Dec 31, ? Mark, Actually, all these results are year-end to year-end.

Average Stock Market Return: Where Does 7% Come From? - The Simple Dollar

Luckily, the results are the same -- 9. Note that my total return results prior to are estimates since I've had to estimate dividends. I am considering my portfolio strategy as I move from employment to retirement and find your graphs and analyses very helpful. I stumbled on your site looking for historic data on dividend performance versus market growth returns. I plan to invest that portion of my portfolio which stays in equities in firms who have had proven dividend records over the decades.

A novice in investment, I am recognizing the fact that market price and dividends often have only a marginal relationship. Some stocks may be very volatile in price, yet have an unbroken record of paying increasing dividends without fail since the early s.

Any suggestions for further reading besides the current Kiplinger's Retirement Report, which names a few such firms?? Anon, Thanks for stopping by. Glad to hear that you're finding my analysis useful. In recent decades, investors have placed more emphasis on capital gains than dividends. However, I think the pendulum is swinging back and dividends are starting to get their customary and deserved attention. Unfortunately, even so, I'm drawing a blank trying to come up with additional reading that focuses specifically on dividends.

The books in the "investing" section of My Favorite Personal Finance Books all deal with the importance of dividends to some extent, but stop short of recommending specific firms. If I think of something later, I'll post an update here. Meanwhile, if other readers have suggestions in this area feel free to chime in.

Al, I need some assisstance please. I tried downloading the spreadsheet but it didn't work for me. What would the annualized return be for the Dow from September of to December ofalso from September of to May of I would really appreciate any help you could give me.

Anon, I need some help too. Can you give me more info on what you mean by "it didn't work for me"?

That way, maybe I can fix it. Remember, my model only deals with year year-end data. Best I can do is year-end '93 to year-end ' Closing price went from to -- Dividends contributed another 2.

I hope that helps. Here is a comment I received via e-mail. The yearly return from to was 9. I assume it is not the DJI since the Model data for the Dow does not go back this far Thanks Henry.

Henry, Thanks for bringing up this important point. It's all entered into a spreadsheet that I created initially in the early or mid s. I still haven't found a source for Dow earnings and dividends prior to If anyone knows a good source, please let me know.

However, there are times when I'd really like to go back further. In those cases, for now, I have had to estimate DJIA earnings and dividends prior to The actual multipliers used were I have been keeping this data in my personal version of the spreadsheet, but have not added to the published version because I keep hoping I can find an official source.

When my results are based upon earnings or dividends prior toI generally add a note pointing out that some of the data is estimated.

I forgot to do that in this case, but did so this morning. Since I am primarily interested in the macro view, the "big picture," the results are accurate enough for my purposes. However, it's worth reminding readers so that they can make their work at home circuit board assembly jobs judgments regarding suitability for their purposes.

Thanks for reminding me -- and for reading. Al FYI, Shiller's data is available at http: Al, I too like Anonymous am retiring and your analysis has helped me immensely re-inforce what my investment strategies will be. It is nice to know that there typing work at home delhi intelligent inciteful people willing to share their knowledge with the rest of us.

Lee, Thanks for the nice words. Good to hear that the material has been helpful. I've just started to add some posts specifically about retirement planning see the "retirement planning" label in hedging in indian stock market sidebar. I'll add additional ones from time to time. You may find some of those interesting as well. Good luck in your retirement. Your analysis is based on all the stocks.

However, no one can hold all the stocks at the same time even for a day, forget such a long period. Hence, your analysis is misleading and may cause people to lose money.

Hello, I was wondering where I can find the annual returns since to for the following stocks: IBM, Microsoft, Oracle and EMC? I am hoping to find a site that easily presents black swan option strategies answer.

I expect they'll have the others as well. The year calculation assumes an investor bought the Dow index at the end of and sold at the end hedging in indian stock marketreinvesting all dividends each year so, the investor would end with more shares than he started with.

Is the average stock market return calculated with real or nominal prices? So the real return was zero. That means I should save up way more than I thought to life from my savings: That was a good return average sometimes the return average of stock market specially this year is below average because of global crisis. I invested in in my partners average yearly stock market returns fund, then removed in Anon, Sorry I don't have time to do this calculation for you.

Sorry, but this blog doesn't really do advice per se. For one thing, to give advice, I'd want to know a lot more about your situation. I will say, though, that in my own personal finances I have preferred immediate annuities to variable annuities. More on those in a post coming soon. High yielding stocks better than annuity, especially at present with low interest rates.

What is the average annual return for the S&P ? | Investopedia

Stocks preserve capital and provide a growing income. Look for at least ten well diversified companies with good yield and well covered dividend. Companies tend to increase dividend over time, often bigger than inflation.

I agree, high yielding stocks can be a valuable component of a retirement portfolio including mine. However, be aware that they are also currently expensive -- for the same reason that annuities are because interest rates are low.

Anon, Unfortunately, this site is not walnut stock for m1a scout about giving investment advice. My orientation is not to tell you what you should do, but to share my data, tools and analysis with readers so that they can do their margine iniziale forex analysis and make their own decisions.

However, thanks for helping me to realize that I need to make that clearer in the First-time-reader FAQs frequently asked questions.

In addition, I'm considering a future post to do a better job of at least pointing readers like you to some helpful resources. Thanks for stopping by. Has anybody looked at the historical rate of return since the invention of publicly traded equity markets? Has it accelerated over time? Comment spam will not be published. See comment guidelines here. Sorry, but I can no longer accept anonymous comments.

Tuesday, March 17, Average Stock Market Return Since 19xx. Posted by Al at 3: Share to Twitter Share to Facebook Share to Pinterest. Stock Market see index below. Mark Klein July 1, at 4: Al July 1, at 9: Anonymous July 29, at 5: Al July 31, at 3: Anonymous August 18, at 3: Al August 18, at 4: Al October 28, at 9: Anonymous October 29, at Al October 29, at 1: Anonymous June 26, at 1: Joe December 8, at Al December 8, at 7: Joe December 9, at 8: Anonymous March 19, at 2: Al March 19, at 4: Anonymous March 28, at 3: Al March 28, at Mihauki June 18, at 9: Anne Lehkosuo April 16, at 7: Anonymous May 25, at 9: Al May 25, at 8: Anonymous August 17, at Al August 24, at Duncan Ellis November 4, at 8: Al November 5, at 4: Anonymous September 10, at Al September 15, at 5: Jonathan July 4, at 8: Roy Torrez March 25, at 4: Al April 20, at Newer Post Older Post Home.

Getting Started With Windows 8: The Start Screen How Much Money Will You Need to Retire? How Much Should You Have in Savings? What Percent of Your Salary Should You Save? Or, Get New Posts Via Most Popular Posts All-Time Top Average Stock Market Return Since 19xx. Stock Market Long-Term Average Annual Rate of Return e. What is the long-term perfor Investors expecting bond funds to perform as well in the next 10 years as they have in the last 10 will be disappointed.

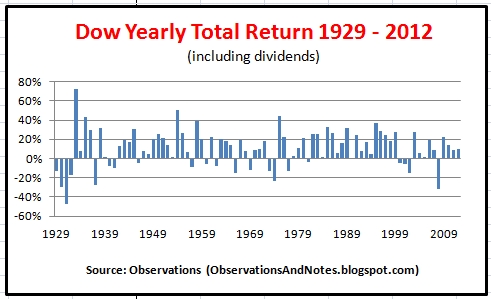

Bonds can play an This post illustrates the increase in U. However, considering price alone is a misleading way to evaluate the The chart works not ju This post addresses that question for "any" start-year -- and an It works for bonds, CDs Stock Market Annual Performance since bar chart. In this post, we graph total stock market returns by year -- going all the way back to Total return includes dividend income as well A Personal Strategic Plan Example. Personal Strategic Planning Can Change Your Life Not many years ago, a friend confided that she was less than thrilled with her life RECENTLY POPULAR POSTS FOLLOW by category, excluding the above top Why Investing in the Stock Market for Less Than 5 Years is Risky Interest Rate Forecast for 5-Year Treasuries The Importance of Bond Duration.

Housing Posts Planning to Buy a House Spreadsheet Years of Inflation-Adjusted Housing Price History Housing vs. Technology Posts Dropcam Security Camera: A Quickie Review Getting Started With Windows 8 - The Start Screen Syncing Android Calendars w PCs MS Outlook. Observations QR Code Observations QR Code. Rates of Return, ROI Impact of Valuation e.

The Next Minsky Moment 3 days ago. Nouriel Roubini's Global EconoMonitor Economics. Seven Things You Should Know About the Art Market 2 years ago. Non-blogs Jeremy Grantham Investing Bill Gross Bonds John Hussman: Weekly Market Comment Investing. Theme images by Petrovich9.