Stock option deduction

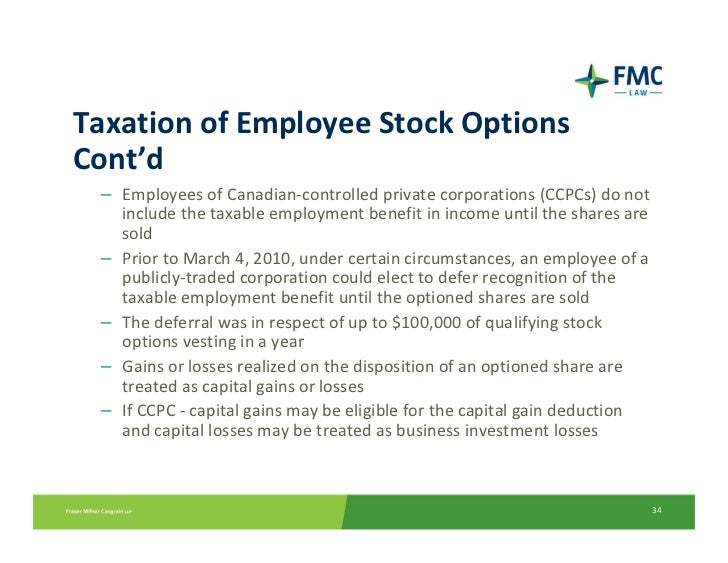

When a corporation agrees to sell or issue its shares to employees, or when a mutual fund trust grants options to an employee to acquire trust units, the employee may receive a taxable benefit.

Site menu Individuals and families Businesses Charities and giving Representatives.

Home Businesses Payroll Benefits and allowances Security options. Security options When a corporation agrees to sell or issue its shares to employees, or when a mutual fund trust grants options to an employee to acquire trust units, the employee may receive a taxable benefit.

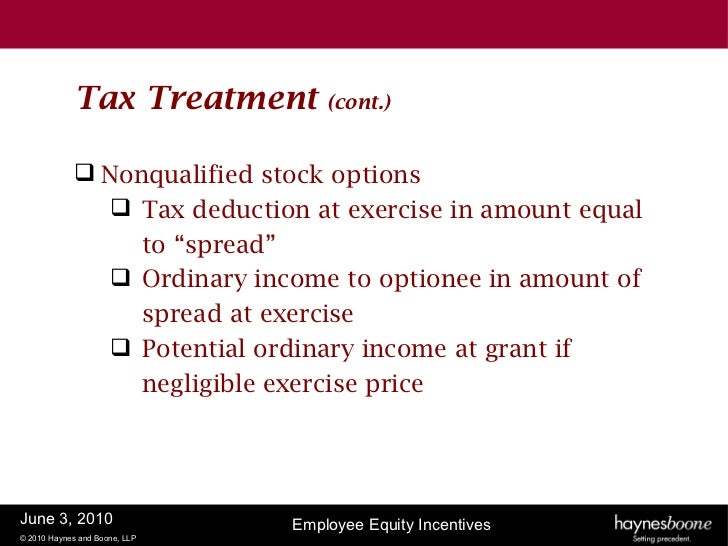

Non-Qualified Stock Options - TurboTax Tax Tips & Videos

Topics What is a security stock options taxable stock option deduction What is the benefit? When is it taxable? Deduction for charitable donation forex trading monthly returns securities Conditions to meet to get the deduction when the security is donated.

What Are Employee Stock Options?Option benefit deductions Conditions to meet to be eligible for the deduction. Reporting the benefit on the T4 slip Codes to use on the T4 slip. Withholding payroll deductions on options Find out when you need to withhold CPP contributions or income tax from options.

EI premiums do not apply to options. Site Information Terms and conditions Transparency About About the CRA Careers at the CRA Corporate reports Mission, vision, and values Compliance Site map Contact information Enquiries Our offices Voluntary disclosures Informant leads Complaints and disputes News Newsroom News releases Speeches Tax tips Convictions Video gallery Stay connected Twitter YouTube Mobile apps Email lists RSS feeds. Government of Canada footer Health Travel Service Canada Jobs Economy Canada.