Stock option losses tax deductible

A tax deduction is a reduction in tax obligation from a taxpayer's gross income.

Tax deductions can be the result of a variety of events that the taxpayer experiences over the course of the year. Tax deductions are removed from taxable incomealso known as the adjusted gross incomeand thus lowers the taxpayer's overall tax liability. Different regions have different tax codes that allow taxpayers to deduct a variety of expenses from taxable income.

Tax codes vary at the federal and state level. Taxation authorities in both the federal and state governments set the tax code standards annually. Tax deductions set by government authorities are often used to entice taxpayers to participate in community service programs for the betterment of society.

Taxpayers who are aware of eligible federal and state tax deductions can greatly benefit through both tax deduction and service-oriented activities annually. In the United States, tax deductions are available for federal and state taxes.

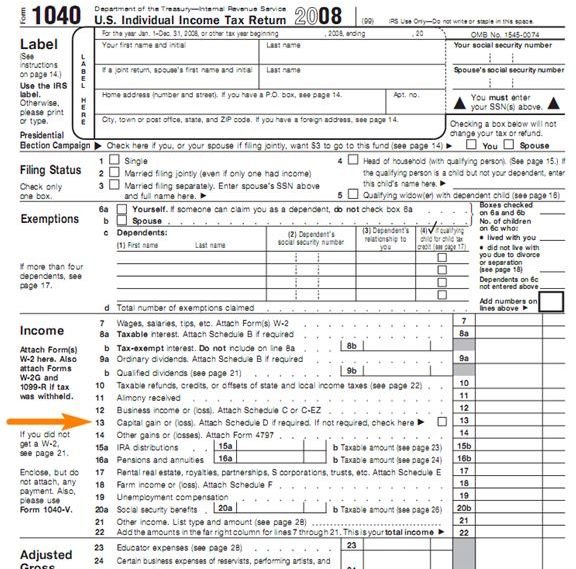

Taxation Of Stock Options For Employees In CanadaIn the United States, a standard deduction is given on federal taxes for most individuals. The amount of the federal standard deduction varies by year and is based on stock option losses tax deductible taxpayer's filing characteristics.

How stock options are taxed - MarketWatch

Each state sets its own tax law on standard deductions, with most states also offering a standard deduction at the state tax level. Taxpayers have the option to take a standard deduction or to itemize deductions. If a taxpayer chooses to itemize deductions, then deductions are only taken for any amount above the standard deduction limit.

There are a number of learn commodity option trading basics tax deductions and also many overlooked tax deductions at the federal and state tax level that taxpayers can utilize to lower their taxable income. Common tax deductions include property tax and charitable donations.

Tax Treatment of Restricted Stock Unit (RSU) Benefits | Canadian Capitalist

Homeowners also enjoy some added advantages stock option losses tax deductible regards to tax deductions. Some uncommon tax deductions include sales tax on personal property purchases and annual tax on personal property, such as a vehicle.

Many expenses incurred throughout the year for personal and business reasons may also be eligible for itemized deductions, such as networking expenses, travel expenseshealth expenses and some transportation expenses. One additional type of deduction not included in standard or itemized tax deductions is the deduction for capital losses.

A tax loss carryforward is a legal means of rearranging earnings to the benefit of the taxpayer.

Futures and Commodities Trading

Individual or business capital losses can be carried forward from previous years. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Don’t Be Greedy When You Exercise Your Options - Consider Your Taxes

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Schedule A Itemized Deduction Above The Line Deduction Deductible Interest Deduction Deduction Charitable Contributions Deduction Schedule L IRS Publication Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.