How to trade etf stocks

Exchange-traded funds ETFs are ideal for beginning investors because of their many benefits likes low expense ratios , abundant liquidity , wide range of investment choices, diversification, low investment threshold, and so on for more see Advantages And Disadvantages of ETFs. These features also make ETFs perfect vehicles for various trading and investment strategies used by new traders and investors. Here are our seven best ETF trading strategies for beginners presented in no particular order.

We begin with the most basic strategy first. Dollar-cost averaging is the technique of buying a certain fixed dollar amount of an asset on a regular schedule, regardless of the changing cost of the asset.

Beginner investors are typically young people who have been in the workforce for a year or two and have a stable income from which they are able to save a little each month. Such investors should take a few hundred dollars every month and instead of placing it into a low-interest saving account, they should invest it in an ETF or a group of ETFs. There are two major advantages of such periodic investing for beginners.

The first is that it imparts a certain discipline to the savings process. As many financial planners recommend, it makes eminent sense to pay yourself first , which is what you achieve by saving regularly. The second is that by investing the same fixed-dollar amount in an ETF every month—the basic premise of dollar-cost averaging feature—you will accumulate more units when the ETF price is low and fewer units when the ETF price is high, thus averaging out the cost of your holdings.

Over time, this approach can pay off handsomely, as long as one sticks to the discipline. Over the three-year period you would have purchased a total of Asset allocation , which means allocating a portion of a portfolio to different asset categories such stocks, bonds, commodities and cash for the purposes of diversification, is a powerful investing tool. Swing trades are trades that seek to take advantage of sizeable swings in stocks or other instruments like currencies or commodities.

In addition, because ETFs are available for many different investment classes and a wide range of sectors, a beginner can choose to trade an ETF that is based on a sector or asset class where he or she has some specific expertise or knowledge. For example, someone with a technological background may have an advantage in trading a technology ETF like the PowerShares QQQ Trust Series 1 QQQ , which tracks the Nasdaq, or the iShares U.

A novice trader who closely tracks the commodity markets may prefer to trade one of the many commodity ETFs available, such as the PowerShares DB Commodity Index Tracking Fund DBC.

Because ETFs are typically baskets of stocks or other assets, they may not exhibit the same degree of upward price movement as a single stock in a bull market. But by the same token, their diversification also makes them less susceptible than single stocks to a big downward move. This provides some protection against capital erosion, which is an important consideration for beginners.

ETFs also make it relatively easy for beginners to execute sector rotation , based on various stages of the economic cycle see Sector Rotation: For example, assume an investor has been invested in the biotechnology sector through the Nasdaq Biotechnology ETF IBB. This can be easily accomplished by buying an ETF like the Consumer Staples AlphaDEX Fund FXG.

Short selling , the sale of a borrowed security or financial instrument , is usually a pretty risky endeavor for most investors and hence not something most beginners should attempt see How Risky Is A Short Sale.

However, short selling through ETFs is preferable to shorting individual stocks because of the lower risk of a short squeeze --a trading scenario in which a security or commodity that has been heavily shorted spikes higher -- as well as the significantly lower cost of borrowing compared with the cost incurred in trying to short a stock with high short interest.

These risk-mitigation considerations are important to a beginner. Short selling through ETFs also enables a trader to take advantage of a broad investment theme. Thus, an advanced beginner if such an obvious oxymoron exists who is familiar with the risks of shorting and wants to initiate a short position in the emerging markets could do so through the iShares MSCI Emerging Markets ETF EEM. However, please note that we strongly recommend beginners stay away from double-leveraged or triple-leveraged inverse ETFs , which seek results equal to twice or thrice the inverse of the one-day price change in an index, because of the significantly higher degree of risk inherent in these ETFs.

For more, refer to Short Selling ETFs by Fidelity Investments.

ETFs are also good tools for beginners to capitalize on seasonal trends. Let's consider two well-known seasonal trends.

Learn to trade ETFs or Exchange Traded Funds

The first one is called the sell in May and go away phenomenon. It refers to the fact that U. The other seasonal trend is the tendency of gold to gain in the months of September and October, thanks to strong demand from India ahead of the wedding season and the Diwali festival of lights, which typically falls between mid-October and mid-November.

A beginner can similarly take advantage of seasonal gold strength by buying units of a popular gold ETF, like the SPDR Gold Trust GLD or the Comex Gold Trust IAU , in late summer and closing out the position after a couple of months. Note that seasonal trends do not always occur as predicted, and stop-losses are generally recommended for such trading positions to cap the risk of large losses.

A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance.

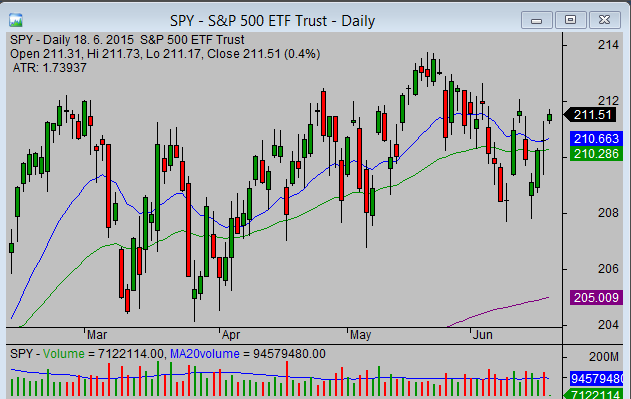

Suppose you have inherited a sizeable portfolio of U. One solution is to buy put options. If the market declines as expected, your blue chip equity position will be hedged effectively since declines in your portfolio will be offset by gains in the short ETF position. Note that your gains would also be capped if the market advances, since gains in your portfolio will be offset by losses in the short ETF position.

Nevertheless, ETFs offer beginners a relatively easy and efficient method of hedging. Exchange-traded funds have many features that make them ideal instruments for beginning traders and investors. Some ETF trading strategies especially suitable for beginners are dollar-cost averaging, asset allocation, swing trading, sector rotation, short selling, seasonal trends and hedging.

isycihe.web.fc2.com: Find the Right ETF - Tools, Ratings, News

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

How To Trade ETFs: A Practical Guide For Retail Investors | isycihe.web.fc2.com

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Dollar-Cost Averaging We begin with the most basic strategy first. Asset Allocation Asset allocation , which means allocating a portion of a portfolio to different asset categories such stocks, bonds, commodities and cash for the purposes of diversification, is a powerful investing tool.

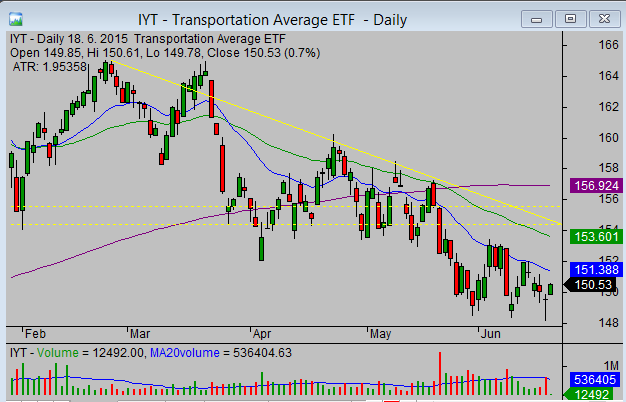

Swing Trading Swing trades are trades that seek to take advantage of sizeable swings in stocks or other instruments like currencies or commodities. Sector Rotation ETFs also make it relatively easy for beginners to execute sector rotation , based on various stages of the economic cycle see Sector Rotation: Short Selling Short selling , the sale of a borrowed security or financial instrument , is usually a pretty risky endeavor for most investors and hence not something most beginners should attempt see How Risky Is A Short Sale.

Betting on Seasonal Trends ETFs are also good tools for beginners to capitalize on seasonal trends. Hedging A beginner may occasionally need to hedge or protect against downside risk in a substantial portfolio, perhaps one that has been acquired as the result of an inheritance.

The Bottom Line Exchange-traded funds have many features that make them ideal instruments for beginning traders and investors. As the popularity of ETFs soar, a look at the main benefits of these investment vehicles.

Although more detail and attention may be needed, ETFs can be shorted - and at a great profit. Balance is the key when selecting an all-ETF portfolio that will hedge against market volatility.

Of the hundreds of exchange-traded funds on the market, some are bound to fail. Learn how to pick the best of the bunch. Despite their popularity, exchange traded funds have some drawbacks that investors should know about. ETFs are a low-cost way to get exposure to different markets. But they're not all the same. Investors should research the following key information regarding the ETF before buying it.

With the ongoing ETF boom, ETFs gain more variety and increased competition in the market leads to further investors' advantages compared to index funds.

Explore the phenomenal growth rate of the ETF industry, and learn some of the principal reasons why ETFs are projected to continue to grow at a rapid pace. As a cost-effective way to achieve a broadly diversified portfolio, including hard-to-own but worthwhile assets, ETFs are hard to beat. Learn what exchange-traded funds ETFs are and their advantages to investors, what a portfolio of ETFs is, and discover Discover the extremely far-reaching range of investment asset classes that are available to investors through exchange-traded An expense ratio is determined through an annual A hybrid of debt and equity financing that is typically used to finance the expansion of existing companies.

A period of time in which all factors of production and costs are variable. In the long run, firms are able to adjust all A legal agreement created by the courts between two parties who did not have a previous obligation to each other. A macroeconomic theory to explain the cause-and-effect relationship between rising wages and rising prices, or inflation. A statistical technique used to measure and quantify the level of financial risk within a firm or investment portfolio over No thanks, I prefer not making money.

Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.